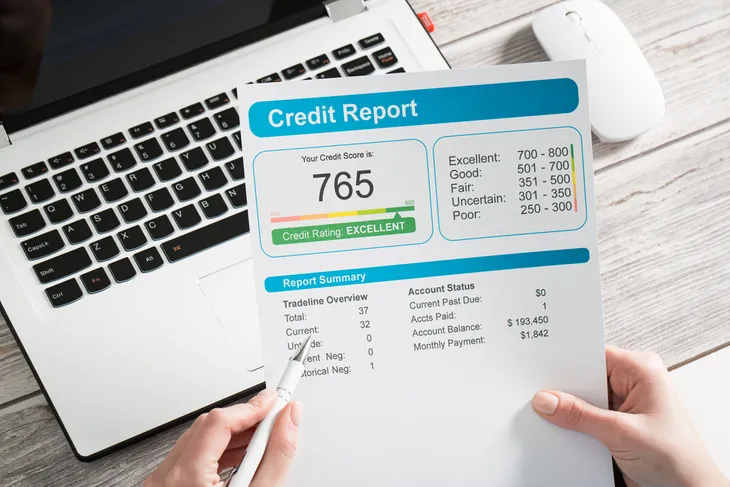

Hopefully you already know the basics of improving and maintaining a good credit score. Pay your bills on time, don’t max out your credit, and keep an eye on your credit report for inaccuracies. However, beyond these basic perennial good habits, there are some other, more surprising ways you can improve your score. For example, did you know that you might be able to get a higher score just… by asking? It’s true, and we’ll tell you more about it in a minute. Here are four things you should be doing to keep your credit score on the up-and-up.

11. Pay Your Bills (On Time)

A simple way to improve your credit score is to avoid late payments. Simply making payments on your outstanding debts, on time, can help keep your credit score high. To help you stay on top of payments and ensure they are made on time each month, consider creating a filing system, either paper or digital, for keeping track of monthly bills.

Another tactic would be to set alerts in your email or on your phone to remind you when a credit payment is due. Lastly, consider automating bill payments from your bank account to ensure they are paid consistently and on-time without you having to think about it. This would be the stress-free approach to bill payments.

10. Make Payments Twice a Month

There is no limit to how often or how much you can pay on your credit cards or other loans. One way to improve your credit score is to make payments twice a month, or once every two weeks. If you’re planning to put $250 on a credit card balance at the end of the month, consider paying $125 at mid-month and another $125 at the end of the month. The credit bureaus will give you credit for making two payments a month rather than one and that will also give your credit score a lift. This is because more frequent payments show that you are serious, and diligent, about paying off your debts.

Also remember that it is never a good idea to carry a large balance on a credit card from one month to the next. The compound interest can lead to the exponential growth of the debt and that is not a good thing. Unless a credit card offers zero per cent interest, then you should only put as much money on that card as you can afford to pay off at the end of the month. The more frequently you pay off the balance in full, the more it will help your credit score.

9. Limit Credit Utilization

Credit utilization refers to the portion of your credit limit that you are using at any given time. If you have a total of $1,000.00 available on a credit card and you have a balance of $250, then your credit utilization rate is 25%. Credit utilization is an most important factor in FICO credit score calculations. Basically, the more credit you use, the more downward pressure it puts on your score.

To keep your credit utilization in check, a general rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there you can work on whittling that down to 10% or less, which is considered ideal for improving a credit score. Of course, this only applies if you are unable to pay your credit card balance in full each month. Paying off your credit card in full is always preferable.

8. Raise Your Credit Limits

Another way to lower your utilization rate is to raise your credit limit on a credit card or line of credit. As a credit limit goes up, the utilization rate automatically drops. Keep in mind though that raising your credit limit only works if you can avoid the temptation to spend the additional credit and increase your overall debt load.

Depending on your credit situation, raising your limit, or even attempting to do so, can backfire. If you are denied a credit increase, it will lead to your credit score taking a hit. Before requesting a credit increase, be sure that you have been making consistent debt payments on time and that your credit score is reasonably healthy.

7. Fix Delinquencies

Delinquencies on a credit report, which refers to missed payments and falling behind on monthly payments to credit card companies, tend to hang around like a bad smell. For this reason, it is important to resolve delinquent accounts, charge-offs or any accounts that have been referred to collection agencies, no matter how hold they happen to be.

If you have an account that has late or missed payments, get caught up on the past due amount, then work out a plan for making future payments on time. That won’t erase the late payments, but it can improve your payment history and that can help your credit score moving forward. Negative account information can remain on your credit history for up to seven years and bankruptcies for 10 years, so take steps to fix these blemishes.

6. Consolidate Debts

If you have several outstanding debts, it is in your interest to take out a debt consolidation loan from a bank or credit union and pay them all off in full. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on that consolidated loan, you’ll be in a position to pay down your debt faster.

Debt consolidations improve credit utilization and, in turn, a credit score. A similar move would be to consolidate multiple credit card balances by paying them off with a balance transfer credit card that offers a zero per cent interest rate for a specified period of time. Such cards often have a promotional period during which they charge no interest on a balance. But beware of balance transfer fees, which can cost as much as 5% of the amount of a balance transfer.

5. Keep Old Accounts Open

Payment history has the biggest impact on a credit score. That is why, for example, it is better to have paid-off debts, such as your old student loans, remain on your record. If you have any debts that have been paid in full, it is good to leave them on your credit report as it helps your score. Closing credit cards while you have a balance on other cards would lower your total amount of available credit and increase your utilization rate. This could knock points off your credit score and lower it.

If you have an old credit card or other loan that has been repaid in full and is sitting at zero and not earning any interest, just let it continue to reside on your credit report. This will help you in the long run as it will offset any other outstanding credit balances you have owing. It might seem counterintuitive, but keeping old, dormant credit accounts open is beneficial.

4. Group Your Loan Shopping

When you apply for any kind of new credit, it can lower your score for up to a year. That’s because lenders will pull your credit report, known as a hard pull. It leaves a mark on your credit report. Applying for multiple credit products (cards, loans, lines of credit, etc) can compound that problem. The credit bureaus will see it as you needing lots of borrowed cash. In turn, that increases the risk that you won’t be able to handle the new debt load. Statistically, those who have six or more hard credit pulls are eight times as likely to file for bankruptcy as those who have none, according to a study done by FICO.

But there’s a big flaw in the system. When you take out a mortgage, auto loan, or student debt, it’s natural to shop around. In fact, we recommend that you go to multiple lenders to ensure you’re getting the best rate. You are still planning to only get one loan. However, there might be multiple hard credit pulls within a short period of time. That can be bad news for your score.

Luckily, the credit bureaus recognize this situation. The scoring formulas will allow for multiple credit inquiries within a certain “shopping window”. This period of time varies for each credit agency, but it’s typically between 14 to 45 days. During that window, multiple inquiries are treated as a single credit application.

So if you are shopping for new credit of any kind, don’t waste time between inquiries. You also want to limit the overall number of times lenders pull your credit. Don’t let them to pull your credit just to get a quote with current interest rates. They should be able to tell their expected rates without a hard credit pull.

3. Ask For a Goodwill Deletion

You never know what you can get just by asking nicely. Let’s say you have one or two late payments on your credit record. No one’s perfect, after all. I bet you didn’t know that you may be able to get your lender to delete them off your record just by asking. This is especially true if you are a long-time and otherwise good customer.

Simply call your lender and request what’s known as a goodwill deletion. Make sure you speak to a supervisor, remain polite, and friendly throughout the conversation. It’s also important to go into the phone call with no expectations. They don’t have to do this. They not even be able to help, depending on the exact circumstances. On the other hand, you might catch them at a good time. They may be willing to help you if you’re pleasant and easy to work with.

2. Don’t Neglect Parking Tickets or Library Fines

We tend to think of municipal fines as something separate from our credit history. However, you could be seriously damaging your credit if you forget to pay a parking or traffic ticket. Or if you still have the library’s copy of War and Peace, despite receiving increasingly desperate communications from the book return enforcement squad. This has become especially important during the pandemic, since we are currently going out less often. So we’re probably holding onto our library books for far longer than normal.

If you end up needing to pay a late fee, just pay what you owe. It would be a mistake to ignore it, dismissing it as “only a library fee.” If these bills go to collection (and they can), your credit score could drop by as much as 100 points. Pay all of your bills on time — even those that are not credit-related. Make sure you hold onto the records of payment too, just in case.

1. Establish a P.O. Box (If You’re Moving a Lot)

Credit scores are all about stability. That means regularly changing addresses, phone numbers, and employers can potentially keep your score lower than you want. Or lower than it reasonably should be. If you know that you’re going to be moving quite a bit over the next few years, take the time to establish a P.O. box and a stable cell phone number. You can provide these to any potential creditors, as they will never change.

Many people are hesitant to do this, since a P.O. Box is just an extra monthly cost. I get it. But think of the big picture. Having one could potentially save you tens of thousands of dollars down the line. If you need a loan or a credit card, your credit score will be in better condition if you have a stable address on record. That will qualify you for higher amounts and lower interest rates. The post office can even forward your mail from the P.O. Box right to you. Although this shouldn’t really be a regular occurrence, considering the ubiquity of online payments and statements.

The Bottom Line

Some people think their credit score is just something they have no control over. However, that far from being the case. With a little bit of know-how and some care, you can boost your credit score by quite a bit. At the very least, you can make smart decisions to keep your score in tip-top shape.

If you’re interested to learn more about your credit score, here are some other great articles to brush up on. This one gives you more detail about how your score is calculated. This article can explain why your score suffered an unexpected drop. If you have no credit history at all, here’s how you can start establishing a score of your own. Finally, here are some common myths about credit scores and why it’s financially smart to keep your score high.